Specialization modules on second-degree part-time studies in the field of Economics

Specialization modules on second-degree part-time studies in the field of Economics

Part-time studies (2nd cycle) introduce so-called specialisation modules.

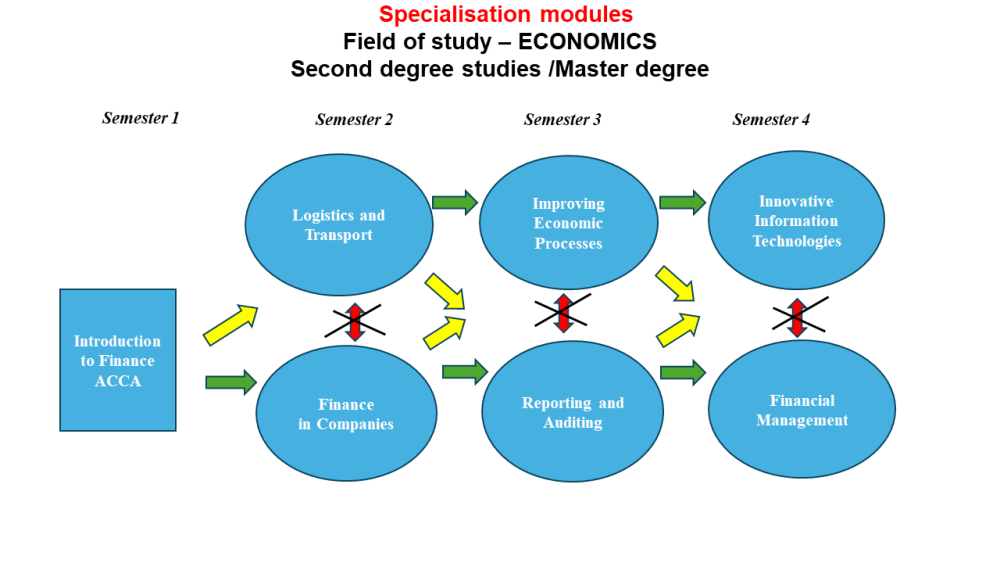

From the first semester of studies, the student takes a general subject, a group of basic subjects, and a group of major subjects. From the second semester, the student chooses a specialisation module, which includes several subjects.

The specificity of such a program allows for a choice between different thematic areas in subsequent semesters of studies. Thanks to this, the student, guided by their interests and ambitions, can independently create their educational path.

The modules in individual semesters are different. They delve into specific areas of economic life, examine the efficiency of economic processes, and end with tools that improve these processes. Independent shaping of the development path allows the student to obtain the comprehensive knowledge necessary for the work of an economist.

Candidates interested in the accredited ACCA program can also choose this path. For these students, an additional set of subjects has been prepared in the first semester as part of the Introduction to Finance ACCA module.

Other modules are chosen from the second semester of studies (Logistics and Transport, Finance in Companies, Improving Economic Processes, Reporting and Auditing, Innovative Information Technologies, Financial Management).

Layout of specialisation modules in individual semesters:

I semester: (additional module for students interested in the accredited ACCA path)

Module A1: Introduction to Finance ACCA

II semester:

Module B1: Logistics and Transport

Module B2: Finance in Companies

III semester:

Module C1: Improving Economic Processes

Module C2: Reporting and Auditing

IV semester:

Module D1: Innovative Information Technologies

Module D2: Financial Management

The launch of the specialisation module will depend on the preferences indicated by students of part-time economics studies. The module will not launch if the required number of students do not sign up (following Resolution No. 71/19 of the Senate of the University of Gdansk of May 23, 2019).

Description of specialisation modules:

Module A1: Introduction to Finance ACCA

The module is intended for students who wish to take exams for the prestigious Association of Chartered Certified Accountants (ACCA) qualification during their studies. Students who have chosen the ACCA path choose the Introduction to Finance ACCA module in their first semester of studies.

This module includes two subjects based on the ACCA program. The first is Fundamentals of Finance and Accounting, an introduction to the ACCA qualification that covers the first three exams: Accountant in Business, Management Accounting, and Financial Accounting. Students who enrol in ACCA also gain the right to exemption from the three ACCA exams listed above.

The second subject based on the ACCA program is Commercial Law. This subject complements knowledge of Business Law (a compulsory subject for the entire course of study). Those who wish can take a particular ACCA-accredited exam covering Business Law and Commercial Law. Students can be exempt from the ACCA Corporate and Business Law exam.

Exemptions are associated with fees paid to ACCA. More on the website:

http://www.accaglobal.com/gb/en/student/acca-qual-student-journey/exemptions.html

Module B1: Logistics and Transport

Logistics is a field of knowledge that relates to almost every purposeful human activity, not only in the scope of their economic activity but also in the implementation of each life function. Every economic process, regardless of whether it is of a material or service production nature, irrespective of whether it is implemented within a single organisation or in cooperation with others, requires various types of logistics activities for its implementation, consisting in the coordinated, synchronised with each implemented production process provision of resources necessary for the implementation of economic processes. Logistic tasks include material, human, and information resources that must be provided at the right place, time, and acceptable costs. Transport plays a significant role in the implementation of such logistics goals. Transport processes determine the duration of the entire logistics process, just as the price of the transport process is often the main item of the expenses of the whole logistics support of almost every economic activity, not to mention the availability of transport in a specific management area.

Logistics management services can be implemented as part of self-service by entities producing all goods or ordered on the market from producers and manufacturers of such services. Economic benefits from the specialisation of production naturally contributed to the creation of the logistics services sector, often referred to in Poland as the TSL sector (transport, forwarding, logistics). Logistics services have become a commodity and operate in full market conditions in the global economy.

Management of logistics processes and systems requires specialist knowledge of the goals and functions of logistics and the ability to identify and optimise logistics processes and systems, which is always multi-criteria. The generally applicable criteria for minimising costs and time in logistics services take on a new dimension of trade-off dependence, and the cost minimisation criterion is only relevant in the calculation of total expenses: production and logistics.

Logistics is becoming an increasingly extensive field of competitive struggle in local and global markets. It is also a source of broadly understood creativity and innovative solutions in the modern world.

Module B2: Finance in Companies

Students of the Finance in Companies module have the opportunity to gain knowledge in Performance Management and Taxation.

As part of Performance Management, students will learn, among others, specialist cost accounting and management accounting techniques, decision-making techniques, budgeting, standard cost accounting and variance analysis, and enterprise performance management systems.

The Taxation subject will enable students to familiarise themselves with the Polish tax system, including the specifics of personal and corporate income tax liabilities, social security and health insurance contributions, and the goods and services tax.

The advantage of studying within this module is that it includes classes with a tax advisor and lecturers with practical knowledge, as well as diplomas from the prestigious Association of Chartered Certified Accountants (ACCA).

For those willing, there is the possibility of taking university exams accredited by ACCA. Passing exams in the ACCA formula allows you to settle the semester of studies at the university and entitles you to exemptions from the Performance management and Taxation exams in ACCA.

Exemptions are combined with fees paid to ACCA. More on the website:

http://www.accaglobal.com/gb/en/student/acca-qual-student-journey/exemptions.html

Module C1: Improving Economic Processes

Economic processes are the only element of economic systems that, together with economic events (e.g. the situation of receiving an order), resources (human, material, information, monetary) and the relations connecting them, enable the transformation of the resources mentioned above into products and services that meet human needs.

Due to the limited resources supplying the processes and the unlimited human needs, this transformation cannot be arbitrarily taken place in an economically effective way. Therefore, actions aimed at improving economic processes and extracting the highest economic efficiency from them are an intrinsic element of everyday economic practice. However, if these actions improving economic processes are to be conscious and purposeful, they should be implemented based on scientific knowledge.

Therefore, the program content of lectures and exercises offered within the module Improving Economic Processes provides knowledge and develops skills in creating concepts and applying methods and tools for improving, rationalising, restructuring and optimising economic processes.

The entire module's theoretical basis is a lecture on contemporary economic challenges, which provides systematised knowledge about problems, expectations, and ways of dealing with financial processes.

This knowledge is detailed in the program content offered within subsequent subjects, particularly developing skills in business planning techniques, financing enterprise development, investment assessment, quality management and modelling and optimisation, considering the specificity of improved economic processes. These subjects' exercises and workshop forms supplement the lectures and allow for the translation of theoretical knowledge into practical ground. This constitutes a high substantive value of the offered economic process improvement module.

Module C2: Reporting and Auditing

The module is intended for students who wish to expand their education in finance and accounting. In this module, students acquire knowledge in Financial Reporting, Fundamentals of Audit, and Audit and Assurance.

Within Financial Reporting, students will expand their knowledge of accounting principles, the regulatory framework of financial reporting, and statement analysis and interpretation. They will also learn how to prepare consolidated financial statements.

During Fundamentals of Audit and Audit and Assurance classes, students will deepen their previously acquired knowledge of finance and accounting by planning internal and external audit processes, conducting audit procedures, and preparing audit reports.

The advantage of studying within this module is that it offers classes with practitioners, such as auditors, certified auditors, and members of the prestigious Association of Chartered Certified Accountants (ACCA).

For those willing, there is the possibility of taking university exams accredited by ACCA. Passing the exams in the ACCA formula allows you to settle your semester of studies at the university. It entitles you to additional exemptions from the ACCA Financial Reporting and Audit and Assurance exams.

Exemptions are connected with fees paid to ACCA. More on the website:

htts://www.accaglobal.com/gb/en/student/acca-qual-student-journey/exemptions.html

Module D1: Innovative Information Technologies

Modern technologies and innovations play an increasingly important role in the contemporary economy. The conditions for the development of modern enterprises, characterised by a dynamic increase in the intensity of competition caused by the globalisation of the economy, the blurring of the boundaries between sectors and the expansion of manufacturers of substitute products, have led to an increase in the importance of information flow, rapid response, global management, coordination and communication. This has led to a change in the perception of information technologies and innovations as a critical factor for the functioning of the enterprise.

The module Innovative Information Technologies is devoted to learning about modern solutions in information and communication technology (ICT), introducing the concept of sectoral and regional innovation, and the functioning of regional and sectoral innovation systems. As part of the classes in the module, it will be possible to get to know in practice (work in computer laboratories) the systems most often used by enterprises to support management processes at all levels of their activity, including tools for implementing logistics processes, business analytics systems, customer relationship management, project management and market research, as well as cloud tools supporting efficient communication.

Module D2: Financial Management

The module is intended for students who wish to expand their education in finance. In this module, students acquire knowledge of Financial Management, Business Valuation, and Risk Management.

The Financial Management subject enables deepening knowledge of the links between finance and enterprise strategy, sources of financing for enterprise operations, and the impact of the economic environment (including markets and financial institutions) on enterprise finances. Students will explore the issues of working capital management, investment assessment, capital structure, and cost of capital.

During Business Valuation and Risk Management classes, students will learn about various methods of valuing enterprises and their shares, the laws governing stock markets, elements of behavioural finance, approaches to risk management, causes of exchange rate differences and interest rate fluctuations, techniques for hedging currency risk, and techniques for hedging the risk of changes in interest rates.

The curriculum is based on the prestigious qualification of the Association of Chartered Certified Accountants (ACCA). Among the lecturers are lecturers with ACCA diplomas.

Those interested can take an exam accredited by ACCA (as part of the Financial Management subject). The exam covers both subjects (Financial Management, Business Valuation and Risk Management) and entitles you to exemptions from the Performance Management exam at ACCA.

Exemptions are connected with fees paid to ACCA. More on the website:

http://www.accaglobal.com/gb/en/student/acca-qual-student-journey/exemptions.html